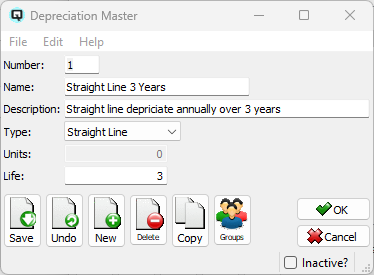

Depreciation Master | DocumentationTable of Contents |

The number for the defined depreciation.

A name for the depreciation.

A description which clearly defines the depreciation.

Select from the depreciation types.

Select "Straight Line". This method involves dividing the cost of the asset by its useful life. The resulting amount is the amount of depreciation that is recognized each year. For example, if an asset costs $10,000 and has a useful life of 5 years, the annual depreciation expense would be $2,000 per year ($10,000 / 5 years).

Select "Declining Balance ". This method involves applying a fixed rate of depreciation to the asset each year. The rate is calculated by dividing 1 by the useful life of the asset, and then multiplying the result by 2. For example, if an asset has a useful life of 5 years, the depreciation rate would be 40% (1 / 5 * 2 = 0.4 or 40%). The depreciation expense each year is calculated by multiplying the asset's book value by the depreciation rate.

Select "Units of Production". This method involves calculating the depreciation based on the number of units produced by the asset each year. The cost of the asset is divided by its expected total production output over its useful life, and then multiplied by the actual units produced in the current year. For example, if an asset costs $10,000, has a useful life of 5 years, and is expected to produce 100,000 units over its life, the depreciation per unit would be $0.10 ($10,000 / 100,000 units). If the asset produced 10,000 units in the current year, the depreciation expense would be $1,000 ($0.10 per unit * 10,000 units).

Define the number of total units that an asset is expected to create over the life of the asset. Used in conjunction with 'Units of Production' depreciations.

Set the number of years over which an asset will be depreciated.

Toggle on or off. Toggle on to set the depreciation to inactive. Toggle off to re-set the depreciation to active.