Customer Return | DocumentationTable of Contents |

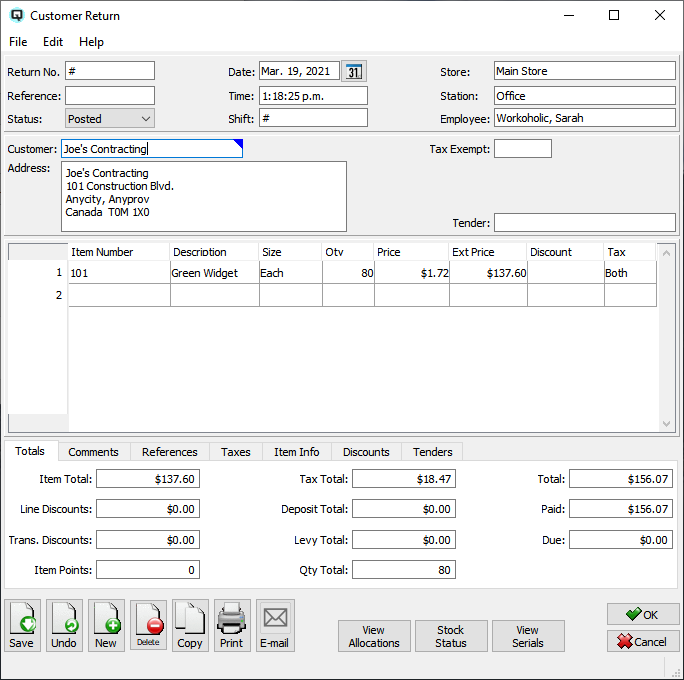

The return number is incremented by Quasar.

This may be changed by the user. If the return number entered is the same as an existing return number then a warning message will be displayed.A number that references the customer return.

For example, you could reference the original customer invoice.The date for the customer return.

The date determines the accounting period in which the customer return will be posted.The time the customer return was created.

The shift that the customer return is linked to through a shift close.

The store in which the customer return is being created.

The station (work station) on which the customer return is created.

The employee creating the customer return.

The status of the customer return.

The default status. Set to "Posted" to post the transaction to the general ledger.

Set to "Suspended" if the customer return is not yet posted to the general ledger.

The customer return is voided or inactive.

Select or enter the customer whom the return is being credited to.

Select or enter the customer unit which the return is being credited to.

The customers address.

Enter the tax code for the taxes that the customer is tax exempt.

If the return will be tendered by a single tender then select the individual tender. If the return will be tendered using multiple tenders, then use the "Tenders" folder.

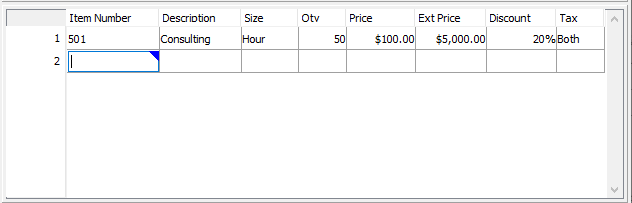

Use this section to enter items on the customer return.

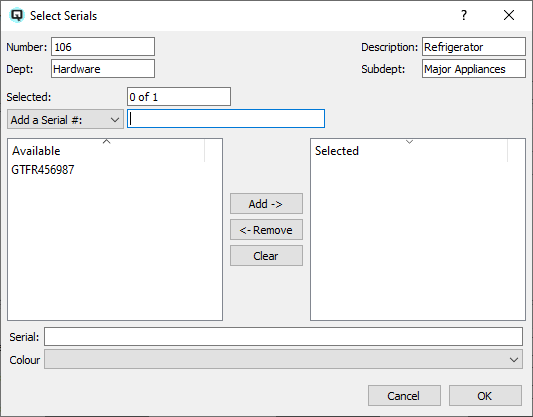

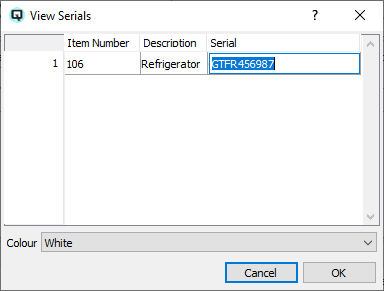

The item number of the product or products being returned. Note that if you enter an item that requires serial number tracking the select serials screen will be displayed.

The description of the product or products being returned.

The size of the item.

The quantity of products being returned. Only a positive number should be entered.

The price per selling unit for each product being returned.

The extended price for the items on the line. The extended price is the gross extended price before discounts.

If the discount is a percent discount then the percentage will be displayed. If the discount is a dollar discount, then the total dollar amount will be displayed. Line discounts are selected in the "Item Info" folder.

The selling tax code for the item. This is defaulted from the data entered in item master window. However, the tax code may be changed by the user.

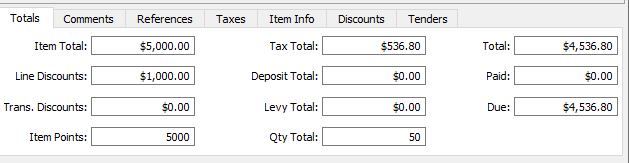

The totals folder displays the various totals for the customer return:

The net item total before discounts and taxes.

The total of all line discounts.

The total of all transaction discounts.

The accumulated total of all taxes.

The total of all container deposits.

The total amount of environmental levies.

The total number of selling units on the return.

The gross total for the customer return.

The amount of all invoices or charges allocated to the return.

The net balance unallocated on the customer return after all allocations.

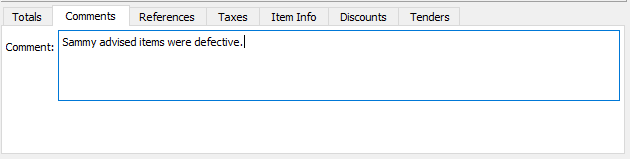

Any comments relevant to the return. All comments will be printed on the hard copy of the customer return.

Displays the compulsory references required. Required references are set in the customer master screen.

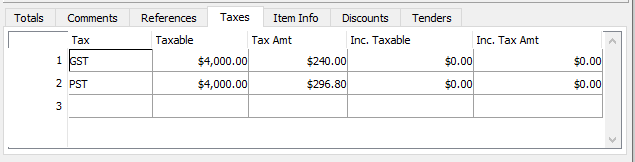

Quasar display a breakdown of the individual taxes.

The tax id.

The name of the tax.

The net base amount that a given tax is charged to.

The amount of tax allocated to the "Taxable" amount.

The net base taxable amount including the amount of the tax. (for items with taxes included in the price)

The net amount of tax calculated from the "Inc. Taxable" amount.

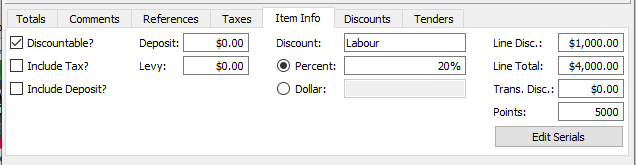

The item info folder displays specific information about an individual item(line) in the return. The information displayed will pertain to the line in which the cursor is placed.

Line discounts are taken using the item info folder.Displays whether or not a discount may be taken on an item.

Displays if the price of the item includes taxes.

Displays if the price of the item includes a container deposit.

The total of the container deposits on the line.

The amount of the levies assessed on the line

Select the discount for to take a line discount.

Toggle on or off. Toggle on if the line discount will be a percentage discount.

Toggle on or off. Toggle on if the line discount will be a dollar discount.

Displays the total amount of a line discount.

Displays the gross total for the line.

Displays total amount of transaction discounts allocated back to the line.

Click on the edit serials button to edit the serial numbers assigned to the item.

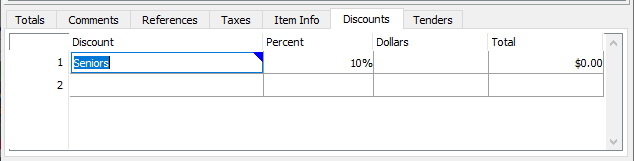

The discounts folder is used to define transaction discounts.

Enter or select the discount id.

from the customer.Enter a percentage discount.

For example "10%" off.Enter a dollar discount.

For example, "$1. 00" off.The total of the discount.

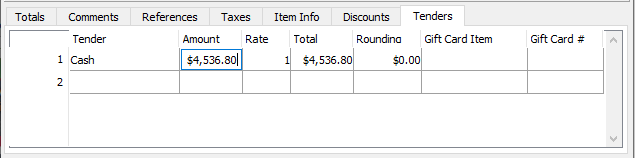

The tenders folder is used to define multiple tenders.

Enter or select the tender.

Enter the amount of the tender.

Quasar displays the conversion rate for foreign currency.

The total of the tender.

If tender rounding is in effect this field displays the rounded amount.Displays the gift card item.

Displays the gift card number.

Click on the "View Allocations" button to allocate allocate an invoice to a return. Clicking on "View Allocation" will cause the "Customer Return Allocation" window to be displayed. This window will display all transactions that can be allocated to the return.

Click on the "Stock" button to review the stock status of the item in the line in which you are working

Click on the view serials button to view items on the return that require serial number tracking.